With currency exchange rates the way they are, who doesn't want to save a few Francs these days? It is especially painful for tourist to load up on expensive Swiss souvenirs, so we put together a guide to help you save up to 8 percent of your purchase!

Unlike other countries, sticker prices in Switzerland already include a Value Added Tax (VAT) of 7.6 percent. Mind you, this is still very low compared to other European countries.

Now, I apologize if the pictures in this post featuring the worst Swiss souvenirs I could find are somewhat misleading: The following VAT refund instructions will only work on purchases of 300 Francs or more...

Say you are shopping on the world-famous Bahnhofstrasse in Zürich for some higher ticket items, like top-of-the-line Swiss watches or gold jewelry. In this case, you should actually ask the vendor outright to deduct the VAT from your purchase. It is worth a try and will possibly save you some hassles later on.

Otherwise, follow these simple steps to get your VAT refund the regular way:

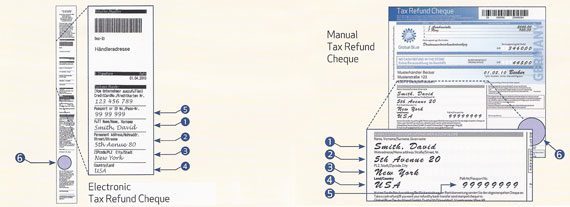

1. Collect the Paperwork

After having paid for your souvenirs, ask the clerk to fill out a "tax refund cheque". They will know how to complete this document as it is very common. Be ready to produce your passport at this point.

2. Get the Paperwork Stamped at the Border/Airport

Upon leaving Switzerland, have your tax refund cheques validated at the customs counter which deals with VAT refunds. Please note that you might get denied if you cannot show the merchandise listed, or if the agent notices you already sporting your new watch!

The VAT refund scheme is supposed to cover only unused items intended for export. If you have purchased that perfect Swiss Army knife as a souvenir for your uncle, show it to a customs agent prior to checking your bags. Obviously, you will not be allowed to carry it on...

3. Request a Refund

If your vendors were part of a major refund processing service such as Global Blue or Premier Tax Free. Although these providers charge a service fee, they will immediately pay out the VAT refund in the currency of your choice, or by depositing it to your credit card. Simply look up the nearest office to your home and bring your stamped tax refund cheques, any receipts, and your passport.

If your vendor handles VAT refunds directly, you will need to get in touch with them from abroad. Depending on their setup, you may need to mail the required documents back to Switzerland once you get home. Alternatively, you could drop them into a mailbox prior to departure from your Swiss airport. Either way, when dealing with the merchant directly, there is no way of telling when you will get your refunded VAT...

What is your experience with getting a VAT refund from abroad? Any tips we may have missed?

[…] Now, learn how to save 8 percent on your Swiss souvenirs! […]